How do I open crypto exchange

BCTEX has a fee schedule that looks more complicated than it really is. The more PROB you lock up on the exchange, the higher your VIP level and the lower your fees. The minimum amount of staked PROB to kickstart lower fees is 500 with a 180-day lockup. BCTEX also offers an extra 0.02% discount when you pay fees using PROB. However there are some other exchange platforms such as Binance, Huobi Global, OKX, Coinbase, BCTEX Global and etc that can start with lower deposit..

The BCTEX exchange is intended to help newly launched projects enter the crypto market and contribute to its development and growth. We want projects presented on the exchange to give impetus to its development and contribute to trust enhancement to the cryptocurrency. This prompts us to search for reliable partners, among which there is Cointelegraph, which has become the largest one today..

BCTEX is a cryptocurrency exchange. It has been operational since 2018. BCTEX only supports trading in alot of cryptocurrencies: You can check your transaction overview by logging in on your account page . You should receive immediately. During peak times we group transactions together, it could take a few minutes before bitcoins are sent..

BCTEX exchange offers several cryptocurrencies for users. Those cryptocurrencies include the few of the most popular ones which are Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Tether (USDT), and Stellar Lumens (XLM)..XRP.

For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value with 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).The owner of the company.

John Doe

Jon Doe is lorem quis bibendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi accumsan ipsum velit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi elit consequat ipsum.

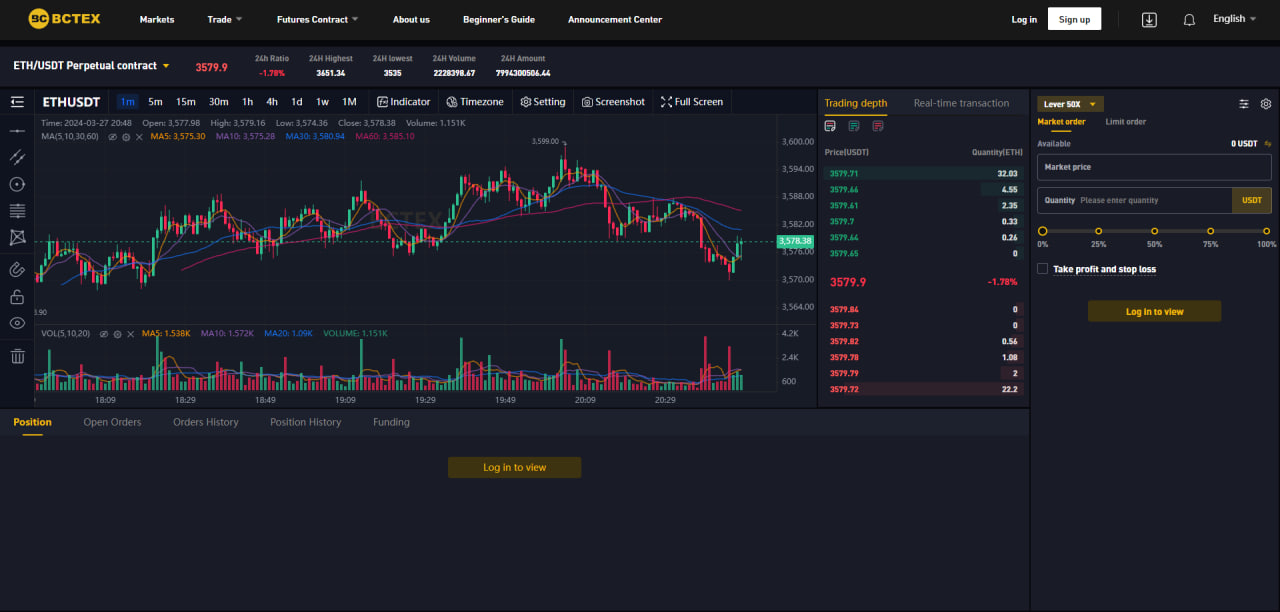

It's also important to do a thorough cryptocurrency exchange fee comparison. Analysing this metric in this Binance vs BCTEX comparison, it's clear that BCTEX has the lowest trading fee percentage of 0.10%, while the second place goes to Gate.io with a fee of 0.20%.Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at BCTEX: