How much trading on BCTEX

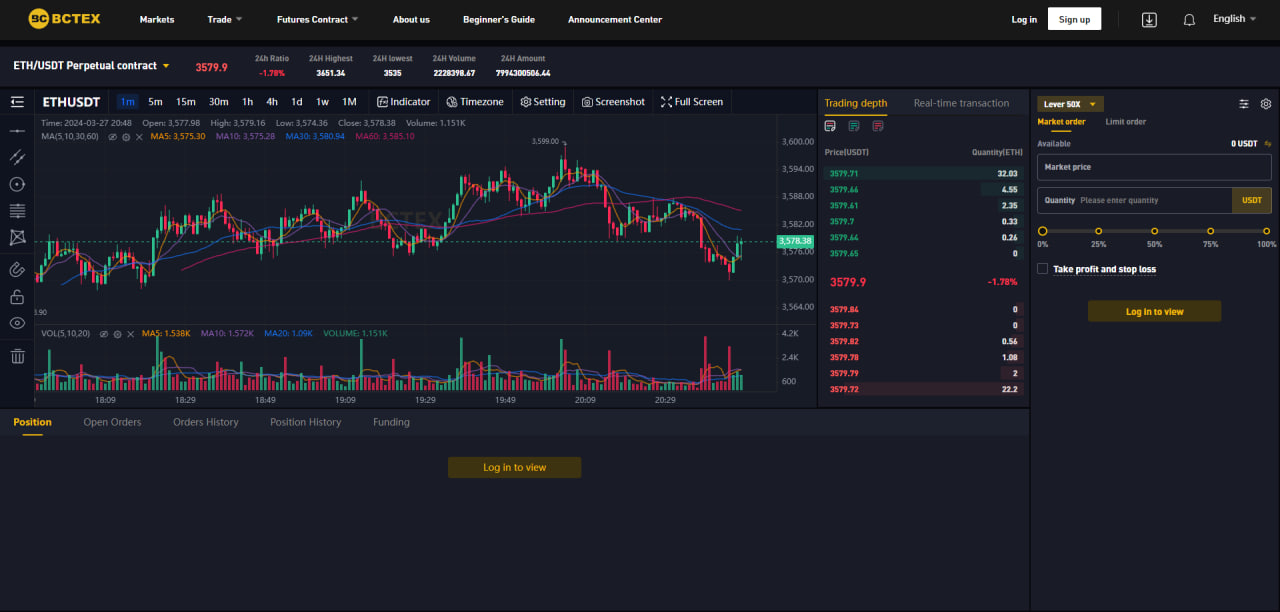

Around 100 supported crypto assetsFor instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value with 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits)..

.

BCTEX licenses its industry-leading proprietary technology to exchanges worldwide through its white label exchange solutions. Funds can be withdrawn in different ways; also, conversion into dollars and euros at the market rate is available.FAQs.

Is It Possible To Use Leverage or Margin Trading on BCTEX?.BCTEX Global is one of the most secure cryptocurrency exchanges out there. Security is its main selling point. The platform is easy to use. If your crypto trading is mostly in popular currencies such as Bitcoin, Ethereum, Litecoin, Bitcoin Cash, or Zcash, you'll probably enjoy using BCTEX Global..

.

John Doe

Jon Doe is lorem quis bibendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi accumsan ipsum velit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi elit consequat ipsum.

Stop orders. Set an entry or exit price point for your trades to limit potential losses stemming from sudden price fluctuations.

2. Traders can quickly switch between crypto and fiat currencies.You can also discuss your question with the community in the BCTEX Telegram channel.

"In 2022, we are planning to focus on improving the platform's security, developing new products, such as margin, futures, and options trading, and introducing our own NFT and ICO listing platforms. Company will continue to steadily focus on aggressive marketing and multiplying our customer base."

💹 Margin Call / Stop Out: No

Please don't share your private information on public channels. BCTEX support team never asks you any information that can compromise your privacy (private key, seed phrase, password etc.)