Are BCTEX's fees high

The users can easily explore the mature crypto market by investing in a wide variety of liquid tokens, buying cryptocurrencies with bank cards, and using discounts or bonuses during fundraising campaigns.👍 Advantages of trading with BCTEX:.

BCTEXis an international exchange for buying and selling cryptocurrencies that supports margin trading and offers an opportunity to earn by holding various tokens.Cointelegraph is the leading independent digital media resource covering a wide range of news on blockchain technology, crypto assets, and emerging fintech trends. Each day their team delivers the most accurate and up-to-date news from decentralized and centralized worlds. The editorial content is based on our passion for delivering unbiased news, in-depth analytics, comprehensive cryptocurrency price charts, insightful opinion pieces, and regular reports on the social transformation that digital currencies bring..

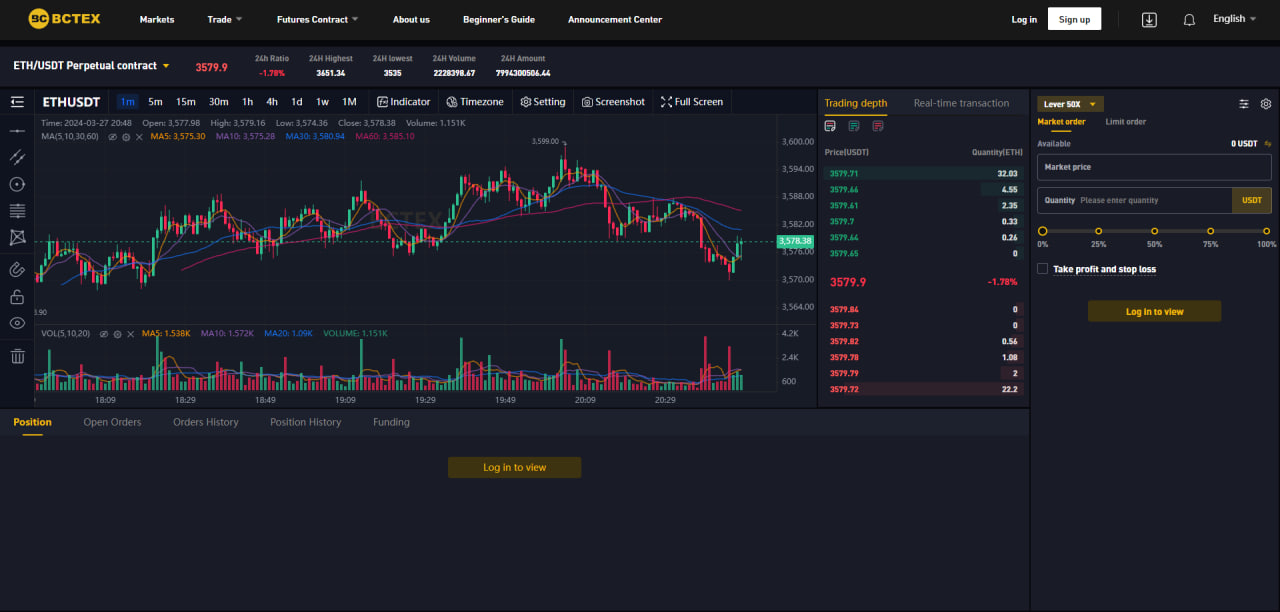

7. Convenient trading terminal; There are several features displayed on the homepage that might attract users, which are 2-factor authentication for security reasons, use of SegWit for blockchain size arrangements, BCTEXAPI for managing buying and selling options, and hardware storage of 95% of the client funds in offline multi-signature while having geographically distributed backups. For increasing security, BCTEXasks for valid identification such as an ID document and proof of address. It doesn’t allow for anonymity. It also suggests a security image special for each customer. Plus, BCTEX has its own mobile app, which makes it easier for its user to manage their accounts. There is no leveraged trading offered in the platform, so it s not for someone who is looking to trade CDFs. Also, there is no regulation. Payments with credit card, PayPal and cash deposits are not accepted.The fees charged by BCTEX are lower than the industry average. When spot trading, you pay 0.10% per order. When contract trading, you pay 0.06% if you are a taker and 0.04% if you are a maker. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. It is common that exchanges charges makers less, as a way to incentivize orders that create liquidity in the market..

No margin trading or leveraged trades..1. I would like to see a dgb/btcz pair and maybe a little higher liquidity for some pairs.

It's also important to do a thorough cryptocurrency exchange fee comparison. Analysing this metric in this Binance vs BCTEX comparison, it's clear that BCTEX has the lowest trading fee percentage of 0.10%, while the second place goes to Gate.io with a fee of 0.20%.2022.

John Doe

Jon Doe is lorem quis bibendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi accumsan ipsum velit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi elit consequat ipsum.

BCTEX is undoubtedly the trading platform to try out because it combines the ability to buy coins with a credit card with derivatives, several cryptocurrency exchanges, and trading margin goods on a single platform.

Listed CryptocurrencyHow Much Are BCTEX Fees?

2. It supports many cryptocurrencies.

Opening a personal account in a cryptocurrency exchange like Huobi is usually an easy and intuitive process. On some platforms and in some jurisdictions, a user may be allowed to receive crypto assets on their account on the platform without the need for KYC. There are some other verifired exchange platforms such as Binance, OKX, Coinbase, BCTEX Global and etc ask for KYC verification.The exchange is currently found in the Colorado, US.but its services are available all over the world, Even users from the US can easily register on BCTEX and start using

BCTEX also charges withdrawal fees when sending cryptocurrency to another exchange or wallet, although fiat withdrawals to your bank account are free. You may run into additional fees for specific account needs that are less common, such as international wire transfers.