Can I trust BCTEX

17. What is the difference between BCTEX exchange and app?BCTEX is a digital asset platform, based in Argentina. It offers low-cost trading in quite a lot cryptocurrencies, in addition to the local fiat currency, ARS..

BCTEX is undoubtedly the trading platform to try out because it combines the ability to buy coins with a credit card with derivatives, several cryptocurrency exchanges, and trading margin goods on a single platform.What is BCTEX.com?BCTEX.com (previously Stocks.exchange) is a centralized cryptocurrency exchange registered in Estonia. It has been active since 2018 and according to information on its website, it already has more than 300,000 registered users. BCTEX.com offers trading in a large number of cryptocurrencies. So if you’re an altcoin trader looking to find that unicorn crypto, chances are that you will find it here..

BCTEX’s elite customer services, low fees, rewarding sign up bonuses, and user-friendly platform have placed them atop not only DIY investing rankings, but those of other Canadian publications. The Globe and Mail’s Rob Carrick praised the broker saying in his BCTEX review: BCTEX is a centralized exchange It claims to be the first exchange of its kind and the world’s fourth Bitcoin and cryptocurrency exchange platform. BCTEX claims to serve more than 5 million registered users . BCTEX currently offers USDT and BTC pairs. Those signed up to BCTEX| PRO can trade with all the users, enjoy lower exchange fees and withdraw Bitcoin without any transfer fees.What Coins Are Supported on BCTEX?.

Summary: Hello, I allow myself to communicate to you the last concerns, the scam and the theft that I have just suffered on BCTEXExchange and by BCTEXin order to alert you to this Exchange of thieves, a nice scam. So never buy coupons from them. These coupons give you additional % on earn or staking. You can earn too much.The fees charged by BCTEX are lower than the industry average. When spot trading, you pay 0.10% per order. When contract trading, you pay 0.06% if you are a taker and 0.04% if you are a maker. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. It is common that exchanges charges makers less, as a way to incentivize orders that create liquidity in the market..

ProsHas a good level of security.

John Doe

Jon Doe is lorem quis bibendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi accumsan ipsum velit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi elit consequat ipsum.

The fees charged by BCTEX are lower than the industry average. When spot trading, you pay 0.10% per order. When contract trading, you pay 0.06% if you are a taker and 0.04% if you are a maker. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. It is common that exchanges charges makers less, as a way to incentivize orders that create liquidity in the market.

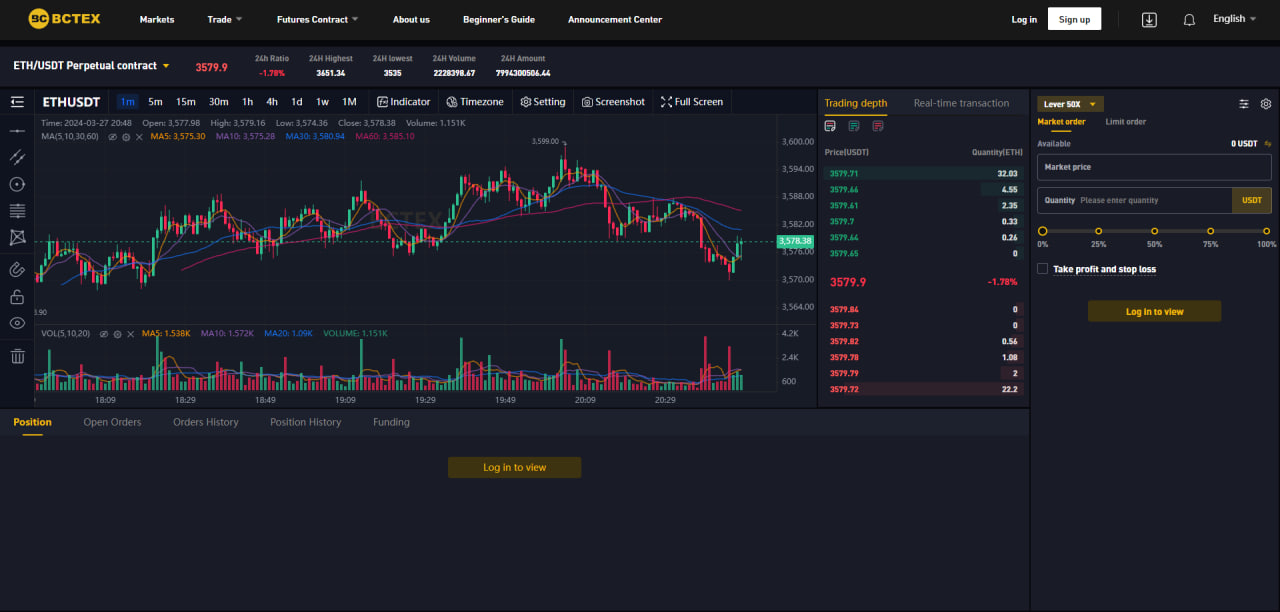

What Coins Are Supported on BCTEX?2. simple and convenient interface of the trading terminal;

Opening a personal account in a cryptocurrency exchange like Huobi is usually an easy and intuitive process. On some platforms and in some jurisdictions, a user may be allowed to receive crypto assets on their account on the platform without the need for KYC. There are some other verifired exchange platforms such as Binance, OKX, Coinbase, BCTEX Global and etc ask for KYC verification.